Jul 4, 2024 FreeMind Network Podcast

Watch the Video Here

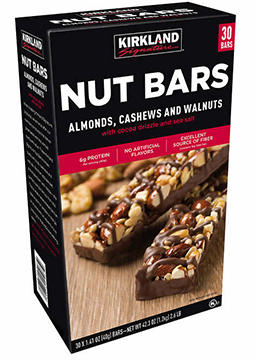

In this episode of the FreeMind Network Podcast, we sit down with Jeremy Smith, the founder and president of Launchpad, to delve into his 26 years of experience helping food and beverage brands break into Costco. Jeremy shares insights into Launchpad’s unique business model, the benefits of focusing exclusively on Costco, and the challenges and triumphs of working with some of the most iconic brands. From discussing the consumer experience in Costco to revealing secrets of successful product placement, Jeremy offers invaluable advice for entrepreneurs looking to scale their businesses.

Key Moments: 0:00 Introduction by Jeremy Smith 1:09 Why Focus Exclusively on Costco 2:10 Launchpad’s Journey and Success 5:28 Advice for Food and Beverage Entrepreneurs 7:04 Consumer Experience at Costco 9:03 Evolution of Costco’s Strategy 12:08 Importance of Integrity in Business 14:41 Early Challenges at Launchpad 18:42 Working with Disruptive and Unique Brands 22:24 Managing Entrepreneurial Expectations 30:01 Importance of Supply Chain Efficiency 37:08 Innovation vs. Line Extensions 44:33 Reflections on Success and Personal Life 53:03 Closing Thoughts