By Sarah Nassauer Features Dow Jones Newswires

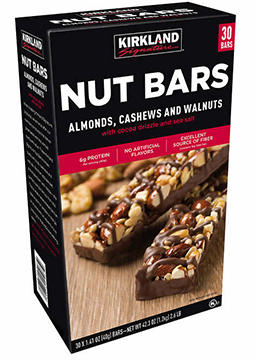

ISSAQUAH, Wash. — Costco Wholesale Corp.’s chocolate-dipped, slightly salty Kirkland Signature Nut Bars became a hit at its stores earlier this year.

Unfortunately for Kind LLC, that meant its own best-selling, chocolate-dipped, slightly salty Kind Bars now faced cheaper competition on Costco’s shelves.

Kirkland Signature, Costco’s store brand, is challenging manufacturers hoping to earn or retain a coveted spot at the warehouse retailer. Since 1995, Costco has used its Kirkland products to attract shoppers, building a reputation for quality and low prices on milk, toilet paper, men’s shirts and golf balls bearing the unassuming red logo. About a quarter of Costco’s $118.7 billion in annual sales come from Kirkland Signature products, and the percentage is growing, company executives say.

LaunchPad Inc. founder Jeremy Smith, who works with food brands seeking Costco shelf space, tells clients: “Assume a ‘KS’ version of your product will come into the market.” When that happens, he said, savvy manufacturers offer Costco new versions of their product, tweak packaging to highlight what’s better about their brand or spend more on marketing — all costs Costco doesn’t incur with Kirkland.

At Costco, negotiating for a spot in stores is a complex dance. Brands fight for space at the retailer’s cavernous warehouses, which on average carry only 3,800 products. The typical supercenter sells over 100,000. Adding to the pressure, Costco often introduces a new Kirkland product when its buyers or executives believe a brand isn’t selling at the lowest possible price.

Today, Costco’s nut aisle is almost entirely made up of Kirkland Signature products, including single-serving packages sold in boxes of 30, bags of almonds and nut clusters. Over a decade ago, what was formerly called Kraft Foods lost spots for its Back to Nature fruit-and-nut mix single-serving packages and several varieties of Planters nuts, said a person familiar with the change.

Leading up to the Kirkland introductions, Kraft raised the price on several nut products without showing the direct justification Costco demands, like an increase in nut prices, and declined Costco’s offer to make Kirkland products, the person said. Since then only a handful of Planters products have been sold at Costco, currently two varieties in some stores and on Costco.com. Because of Costco’s size, the retailer can sometimes buy commodities like nuts at lower prices than consumer-goods companies.

A spokesman for Kraft Heinz Co. declined to comment.

The pressure manufactures face from private brands is set to increase.

Building successful store brands is a priority at Wal-Mart Stores Inc. and Amazon.com Inc. as they battle to boost margins and attract shoppers. After Amazon acquired Whole Foods, it quickly added the grocer’s store brand, 365, to its online food offerings. Wal-Mart and its warehouse chain, Sam’s Club, are reworking and adding to their store brands.

Though Costco’s stock price has suffered amid investor fears that its e-commerce operations aren’t ready to go head-to-head with Amazon, the retailer has kept sales growing, in part by using Kirkland to pressure manufacturers to lower prices and bring products to shelves that can’t be purchased elsewhere.

“If you have something unique, it’s un-Amazonable,” said Simeon Gutman, a retail analyst at Morgan Stanley.

Still, Costco doesn’t aim to become a store that only sells Kirkland products, said Costco finance chief Richard Galanti. Shoppers expect to find brands they know at Costco, and Kirkland looks like a better value next to a higher priced branded version, he said. Often Costco collaborates with brands on products, like its Starbucks-roasted Kirkland coffee beans.

If a Kirkland product doesn’t sell well, it doesn’t stay on shelves, Mr. Galanti said. “We try to be agnostic on it. We try it like any other brand.” In the past, Costco has pulled the plug on store-brand cosmetics, soda and toothpaste.

Some ideas never even hit the aisles, like Kirkland women’s jeans. “Never say never on anything,” said Mr. Galanti, but “the feeling was it wouldn’t work.”

When considering a new store-brand offering, Costco looks for products that are top sellers and can be sold for at least 20% less than branded versions without eroding profit or quality. Kirkland gives Costco “leverage over brand manufacturers” and a product the “competition can’t get,” said Mr. Galanti. Costco is generally careful to make its products slightly different than branded versions.

Buyers at Costco, who spend years at the company before getting the job, “play fair ball, but hard ball” with suppliers, said a food-company executive who has worked to get goods on Costco’s shelves. Before developing a Kirkland product, Costco usually gives a brand-name supplier the chance to make the Kirkland version, too, say company executives.

For years Costco asked Procter & Gamble Co. and Kimberly-Clark Corp., makers of Pampers and Huggies, respectively, to develop a Kirkland premium diaper, said Mr. Galanti. Kimberly-Clark agreed, he said. Costco started selling Kirkland diapers in 2005 and now Huggies are the only branded version sold on Costco shelves.

“We have been pretty adamant across our lines that we don’t manufacture private labels,” said a spokesman for P&G. Kimberly-Clark declined to comment.

Brands often find ways to coexist with Kirkland. About three years ago, Costco buyers calculated that a Kirkland bar similar to a Kind Bar would be 30% cheaper, mostly by cutting marketing costs, said Tess Wilkins, a general merchandise manager at Costco.

Kind Bars sold for about $18 for a pack of 18. “It was a very, very good item for us, and to walk away from those sales, you really have to think hard,” she said.

When almond prices dropped in 2016, Costco decided to proceed, Ms. Wilkins said. Over about five months, Costco developed the Kirkland Signature Nut Bars, made by Leclerc Foods USA, which is owned by Leclerc Group, a Canadian manufacturer, and now sells a 30-pack for $17 in stores.

Kind Bars are still carried at Costco, though mostly new varieties, including fruit bars, mini nut bars and a peanut-free bar. “We look forward to continuing to grow with them,” a Kind spokeswoman said.

Write to Sarah Nassauer at sarah.nassauer@wsj.com